Two thinkers that have had a major impact on my thinking are Richard P. Rumelt, father of the resource view of business strategy, and Marshall McLuhan, the philosopher and media theorist who coined “the medium is the message”. Both have left us with key frameworks for thinking about technological change that are useful for understanding AI’s impact and assessing the opportunities it presents. (The sections on each will be quite distinct and not necessarily connected.)

Strategy

Rumelt’s seminal work is Good Strategy/Bad Strategy, a must-read for getting a grip on what strategy is and how to effectively craft one. According to Rumelt, good strategy has three essential components: diagnosis, guiding policy, and coherent action.

Diagnosis: The diagnosis involves identifying the key challenges or obstacles that the organization faces and zeroing in on what is relevant based on the facts that can be gathered. A doctor uses a patient’s history and current symptoms to make a clinical diagnosis by identifying a disease.

Guiding Policy: The guiding policy is the general approach or direction that the organization will take to address the challenges identified in the diagnosis. It serves as a guide for decision-making and provides a framework for action. Doctors use a therapeutic guiding policy in setting out their responses.

Coherent Action: Coherent action involves the coordinated and focused efforts of the organization to actualize a solution in accordance with the guiding policy. Doctors suggest lifestyle changes, medication, and/or specialized care as a set of coherent actions that work together to therapeutically address the problem diagnosed.

This broader framework for strategy has been very useful for me in making decisions, but when it comes to anticipating the effects of change, I have found a lesser-referenced part of his work useful. In the chapter on Using Dynamics, he presents some guideposts he considers useful for understanding industry or economy-wide changes: Rising Fixed Costs, Regulatory Change, Predictable Biases in Forecasting, Incumbent Response, and Attractor States.

Rising Fixed Costs

The simplest form of transition is triggered by substantial increases in fixed costs, especially product development costs. This increase may force the industry to consolidate because only the largest competitors can cover these fixed charges.

It is already evident that the costs to stay at the cutting edge of AI are rising heavily, with the increasing size of LLMs requiring orders of magnitudes higher compute to service, the shortage of high-performance chips, and the scarcity of the relevant talent to engineer advances as lower-hanging fruit is picked. Rumelt notes that as fixed costs rise, investing early on provides firms with the expertise needed to ride the wave and commercialize better than competitors who can no longer keep up.

Concurrently, however, is the transformation of these rising fixed costs into marginal costs. The rise of cloud and API business models across the AI stack, which have usage-based pricing rather than large fixed costs or regular subscription fees helps amortize some of the expense. AI companies like Jasper that have built high-margin businesses on top of APIs can then amass the capital required to invest in the R&D required to push models forward themselves. For much of the software business though thinking in terms of marginal costs is difficult as the industry was built on a build once and sell many times paradigm.

Regulatory Change

Many major transitions are triggered by major changes in government policy, especially deregulation. In the past [forty-five] years, the federal government has dramatically changed the rules it imposes on the aviation, finance, banking, cable television, trucking, and telecommunications industries. In each case, the competitive terrain shifted dramatically.

While much of recent history has been the story of deregulation intensifying price competition and opening up the space for new disruptors, the future regulatory landscape looks less certain. In thinking of how AI businesses will take off it’s useful to think about what dominant businesses are propped up by a regulatory apparatus that is changing.

A few examples that come to mind are Meta and TikTok. With Meta, Apple’s quasi-state regulator power has demolished its existing business model relying on third-party data through App Tracking Transparency (ATT). Some argue that the broader tech recession has been a result of the effects of ATT and its complete reorganization of the ad-driven digital economy. In the wake of this, there are several paths AI use can take.

One is that AI-powered applications would require usage or subscription pricing models to be profitable as ad performance deteriorates across mobile. Understanding whether a product is something that someone would pay for directly rather than needing their attention subsidized by advertising helps to assess its potential.

The other routes are the effects AI could have on advertising itself. TikTok is probably the most successful AI-driven product on the market right now, being optimized for first-party data collection and user retention/engagement. Its dominance however is also subject to regulatory uncertainty as geopolitical competition around AI may likely lead to Western countries banning the product and restricting access for Chinese tech companies to their markets more broadly. Replicating TikTok’s success, and building it not only with recommendation engines but generative engines in mind, may be the new super app.

The long tail of ad buyers that are serviced by companies like Facebook and TikTok without large creative teams may also benefit from Generative Advertising tools that speed up their creation workflow, using the increased volume of advertising to increase conversions. While the margins would decrease, the rising volume of advertising may compensate (though finding a good steady state where this doesn’t further decrease ad revenue is an open question).

Another path is for advertising to change from targeted to contextual, a move Reddit is poised to take advantage of. Reddit’s importance to the training of LLMs has been acknowledged by senior leadership who are now charging for API access.

ATT and restrictions on Chinese products are only a snippet of the regulatory changes that are affecting existing business models, but highlight the direction that AI takes will in some sense be dictated by how regulatory changes affect the playing field.

Predictable Biases in Forecasting

In seeing what is happening during a change it is helpful to understand that you will be surrounded by predictable biases in forecasting. For instance, people rarely predict that a business or economic trend will peak and then decline…The logic of the situation is counterintuitive to many people the faster the uptake of a durable product, the sooner the market will be saturated.

Another bias is that, faced with a wave of change, the standard forecast will be for a “battle of the titans.” This prediction, that the market leaders will duke it out for supremacy, undercutting the middle-sized and smaller firms, is sometimes correct but tends to be applied to almost all situations.

A third common bias is that, in a time of transition, the standard advice offered by consultants and other analysts will be to adopt the strategies of those competitors that are currently the largest, the most profitable, or showing the largest rates of stock price appreciation. Or, more simply, they predict that the future winners will be, or will look like, the current apparent winners.

Each of these biases affects forecasts of AI right now and creates opportunities to try new things. Given the speed at which recent AI advances were adopted such as Stable Diffusion and ChatGPT, forecasters might just expect them to be part of every product and used by everyone in the near future. Similarly, the pace at which models have improved would suggest that they would be able to replace swaths of jobs in the near future. While these are focused on the future, those who are working on making more retentive features around existing capabilities can lock in users before things get better.

In my mind for example Jasper’s customer base may end up being more loyal to Jasper than it is to OpenAI. Expecting foundation models to improve dramatically to completely general use, thereby wiping out the businesses based on fine-tuning those models for specific verticals feels suspect given that businesses are already cropping up to respond to the limitations of the models as currently existing and become plugged into workflows. Even if the models improved, switching costs are higher for the customers than they would be for the vertical-specific business on top of some AI API, which can more easily switch providers.

This logic also applies to the “battle of the titans” bias that has been portrayed between Microsoft/OpenAI vs Google. They have existing business models to protect, hence Google’s slowness to cannibalize all of search’s enormous profit margins via releasing an AI search chat which would be incredibly expensive to run and uncertain to monetize.

The optimal business model for an AI world is an open question, with usage-based pricing currently being the norm among dominant players. Usage-based pricing, however, has to prove a high ROI to justify continued growth in usage which may slow down adoption. It is likely that working backward from ideal economics someone can come to build an AI business that blows away existing ones.

Incumbent Response

In general, we expect incumbent firms to resist a transition that threatens to undermine the complex skills and valuable positions they have accumulated over time.

As mentioned Google has been resistant to ship products that cannibalize on their existing business models. Microsoft on the other hand is extremely willing to spend more incrementally on each Bing search given the enormous fixed costs that went into the product that they can now spread over more users. The market share war won’t last forever and understanding the economics of each business and assessing whether AI either improves or harms ROI can give a pretty good forecast of which incumbents will be eager to adopt AI and for what. Existing search economics are hurt by using AI more, but it’s likely that Microsoft’s suite of products from Office365 and RPA tools like PowerAutomate can all become increasingly integral to corporate stacks and justify higher pricing that covers the rising costs.

Attractor States

In thinking about change I have found it very helpful to use the concept of an attractor state. An industry attractor state describes how the industry “should” work in the light of technological forces and the structure of demand. By saying “should,” I mean to emphasize an evolution in the direction of efficiency meeting the needs and demands of buyers as efficiently as possible. Having a clear point of view about an industry’s attractor state helps one ride the wave of change with more grace.

To me the equilibrium state for AI adoption across industries is a bimodal distribution. In content for example, the returns to existing brands with large followings or troves of IP far outweigh those to small and mid-sized creators. For these larger players there exists excess demand for their products, and using AI to alleviate supply constraints by making it cheaper and faster to produce more content, and to more effectively surface that content for the right person, increases their dominance. On the other end of the spectrum, there will be a lot more creators entering and producing content giving the dropping barriers, but they likely will have a hard time finding large audiences.

We see this content issue somewhat playing out in video already. If we put blockbuster cinema, genre television, and user-generated content on a continuum of appeal there’s the largest market for blockbusters, a mid-sized market for each genre show, and a small market for each piece of UGC. In aggregate though UGC consumes more time than the other because there’s a lot more of it, while blockbuster cinema is hard to create so it consumes the least aggregate hours. The market for genre television though has started to erode, as Netflix has seen decreasing user engagement, as more user attention is pulled to either extreme. If Disney could extend the attention on each piece of media through AI transformations, while UGC continues to be created even faster, it is unlikely to me that mid-market fare would draw an audience.

In other industries, similar dynamics are expected, with superstar firms or individuals reaping growing rewards while more entrants are able to carve out small niches and compete more aggressively with mid-sized players. (David Autor is one of my favorite researchers on the topic of bifurcation of work, highly recommend his work.)

Philosophy

Marshall McLuhan’s work on media theory provides a powerful method for understanding technological change. While philosophical theories have a very different color and approach to business ones, thinking of them slowly can lead to the formulation of incredibly actionable insights. His thesis that “the medium is the message” runs counter to the “content is king” philosophy that guides much of modern social media, with practical implications.

For example, Spotify launched an audiobook feature in the US in late 2022 and has been expanding it to other countries this year. Spotify has been a late entrant to the audiobook game. Amazon acquired Audible in 2008, making it a key feature of its books platform with a dominant market share in audiobooks. The Amazon approach has followed the “content is king” idea where a user cares more about the content than the format. They may read part of a book while at home, then want to continue it as an audiobook when they hop in their car. Spotify on the other hand is a medium bet, that audio as a format is the key criteria for consumption, and the content that is consumed is subsidiary to the format. Spotify is what you put on while driving, so adding more content is good as long as it is audio, be it music, podcasts, or audiobooks. Converting the same content into different formats, such as physical books or videos for podcasts would not do much for Spotify’s user growth or retention. (We’ll see how this feature plays out in the coming years.)

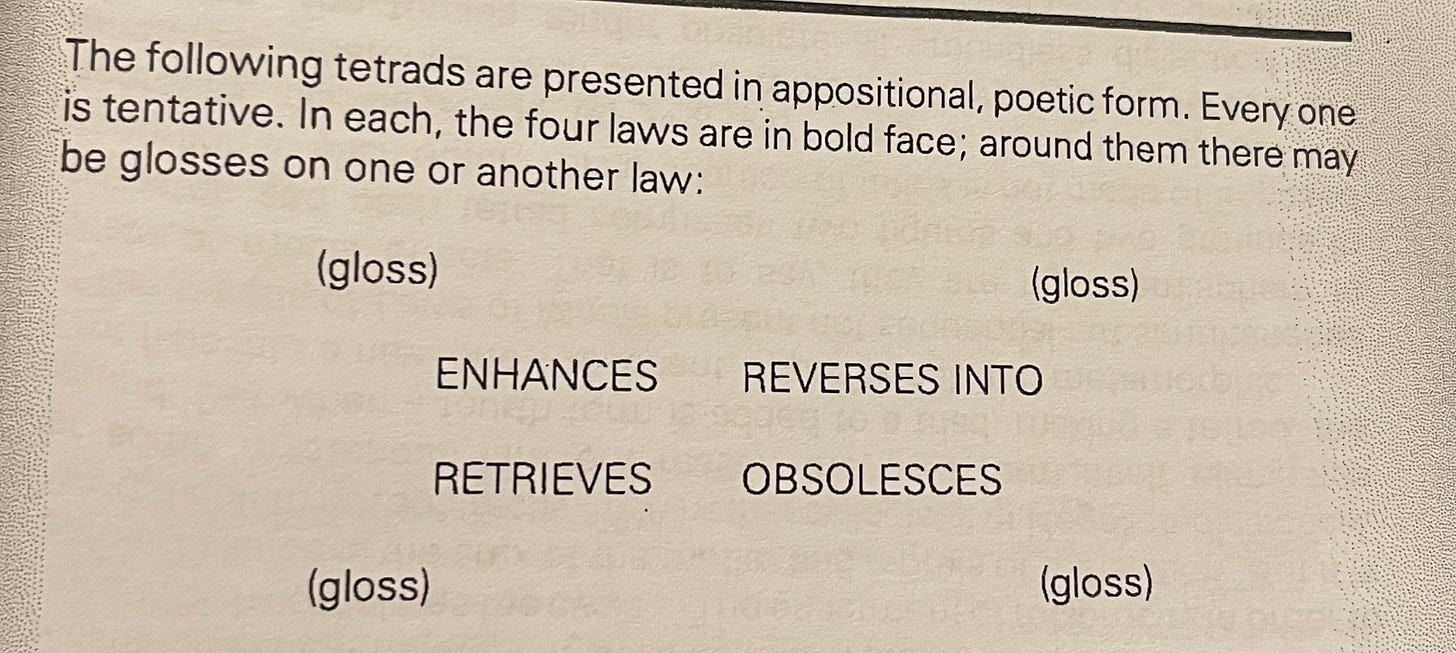

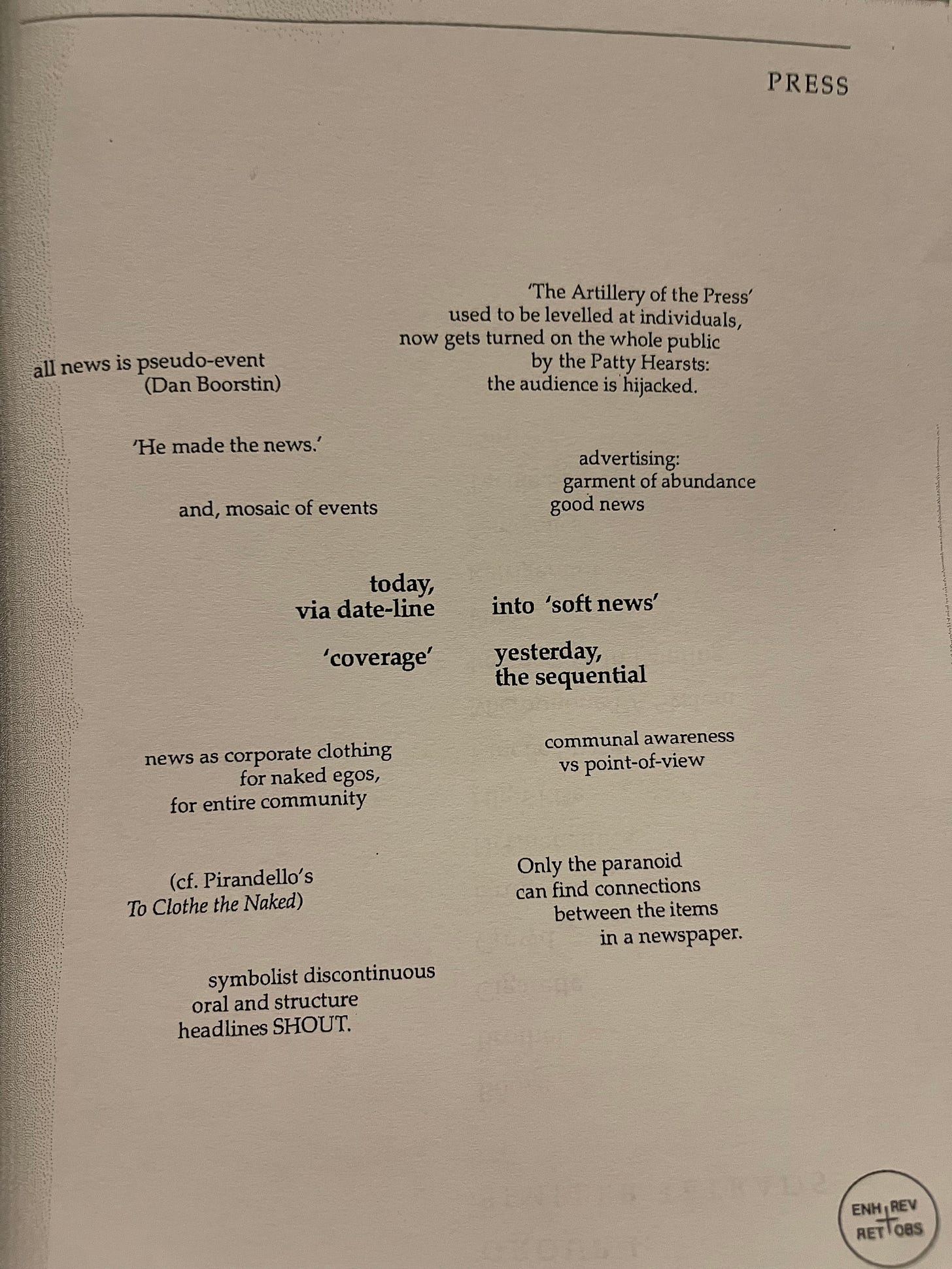

As AIs become multimodal, thinking of their usage through a media lens helps to make bets on how they will be used and their impact. Another McLuhan framework to draw on is the tetrad of media effects from Understanding Media: Enhancement, Obsolescence, Retrieval, and Reversal.

More of the foundation of this New Science consists of proper and systematic procedure. We propose no underlying theory to attack or defend, but rather a heuristic device, a set of four questions, which we call a tetrad. They can be asked (and the answers checked) by anyone, anywhere, at any time, about any human artefact. The tetrad was found by asking, ‘What general, verifiable (that is, testable) statements can be made about all media?’ We were surprised to find only four, here posed as questions:

What does it enhance or intensify?

What does it render obsolete or displace?

What does it retrieve that was previously obsolesced?

What does it produce or become when pressed to an extreme?

Enhancement

Similar to how the computer enhances the speed of calculation and retrieval, AI enhances the speed of prediction and action. Data can be interpreted, solutions proposed, and actions taken with ever greater speed. Just as how increased speed and decreased cost of calculation and retrieval encouraged the reframing of problems to be computed we can anticipate more problems to reframed as prediction tasks where data, objectives, and policies are given and AI can carry out the rest of the process.

Thinking of which tasks are best suited to reframe in this way and where the greatest opportunity for gain is can help understand the present opportunities.

Obsolescence

McLuhan noted the increasing obsolescence of sequential reasoning and slow thinking as media became faster and more abundant. The press obsolesced “yesterday” with a focus on today’s news and the current digital media cycle has made information so fast that often news is outdated only 15 minutes after being consumed. We are currently still limited by the speed at which humans process information though we can imagine the speed increasing to the point that the present itself becomes too slow and already outdated. We see with the rapid development of AI that models and frameworks can become outdated as soon as they are announced. AIs can start developing AIs faster than we can to carry out tasks even faster.

Such obsolescence of the present requires the development of strategies to be more future focussed. A world of increasingly powerful predictions is one constantly in the future. Just as McLuhan proposed his concept of the “Global Village” for how tribal groupings built around fundamental markers of belief or identity would guide group understanding in a world in which information is too fast to process, it may come that created future-oriented systems of identity such as shared visions or missions becomes a new way to organize and make sense of the present.

Retrieval

AI retrieves the idea of the personal in a newly feasible way. TikTok’s recommendation engine shows us stuff that our friends may like, but often times we see videos that feel like they were made just for us, an audience of one. As the barriers to create fall, people create things just for themselves and find audiences through that personal creation. It is more economically feasible than ever to create custom goods, retrieving artisanal practices subdued by the industrial revolution and the era of mass man.

Reversal

The speed of the car reverses into the traffic jam, the distribution of the press reverses into advertising as news, the globalization of the internet reverses into balkanization. It’s entirely possible that the speed at which actions can be taken leads to a world in which AIs are used to carry out entirely contradictory actions leading to a completely steady state in which nothing gets done. The faster the systems move the less oversight is possible to understand whether anything is happening at all. We can already see ChatGPT’s factual limitations creating avenues for misinformation that are entirely not intended by humans.

This fast-paced, globally interconnected world may reverse into a slow-paced, local world. The watch industry is a great example of how the advent of quartz watches dropping the production cost of reliable watches to near-zero reversed the industry to focus on prized, expensive luxury pieces that would not have been mainstays of the watch industry prior.